The Ultimate Travel Credit Card

6% Extra Savings,

Every Time You Travel!

MakeMyTrip ICICI Bank Credit Card

Get 2 Cards, Mastercard & RuPay!

Extra Rewards on hotel bookings

3% on flight, cab, bus & 1% on all outside MMT spends

🤩 Over and above the usual MakeMyTrip discounts & coupons

Guaranteed Reward on UPI Spends

1% myCash + additional upto 1% RuPay coins

Zero Effective Forex Cost

0.99% markup & 1% myCash rewards

✈️ Accepted in over 200+ countries, No hidden fees

myCash That Never Expires

1 myCash = 1 Rupee .

Unlimited usage with no expiry & no restirctions

Bonus Benefits

Enjoy Double Card Power

Avail Credit via both Mastercard & RuPay for online, offline , UPI and international transactions in a single credit card statement

8 Domestic & 1 International

Airport Lounge Access Per Year

No minimum spends required to enjoy this.

Plus you get a complimentary priority pass

View complete list of lounges accepting our cards

Enjoy Double Card Power

Avail Credit via both Mastercard & Rupay

for UPI, all in a single credit statement

Zero Cost 3-Months EMI

0% EMI for 3 Months on MMT Transactions. Book now, pay later — with no extra cost.

Plus, you still earn full rewards on EMI spends

Join Us, Unlock ₹7,000 Travel Rewards

A Grand Welcome Awaits!

Join us and unlock an incredible welcome package worth ₹7,000 & more crafted to make your travels truly delightful!

Complimentary MMTBLACK GOLD Membership

- ₹7,000 Holiday gift vouchers

- Min 10% additional discount on select hotels; free room upgrades

- 25% flat discount on Flight meals, Free date change, Zero cancellation

- Assured customer care call pickup in 30 seconds

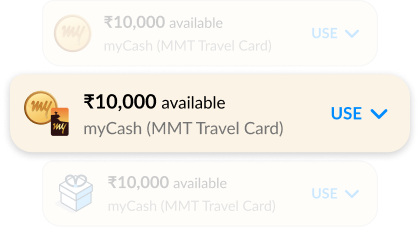

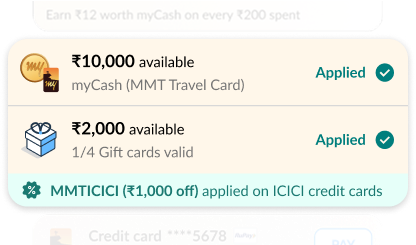

Pay 100% of any MMT Booking Value with myCash Rewards

Unlimited Usage With No Limits, No Restrictions, No Expiry, No Minimums

Use ₹1 worth or your full myCash balance on your booking

1 myCash = 1 Rupee

Auto-Shown at Checkout

We auto-show your earned rewards during checkout across MakeMyTrip

Works with Everything = Extra Benefits

Usable with coupon codes, gift cards, UPI, Netbanking or any other payment option

Limited Time Offer - ₹0 Joining Fee

Joining Fee: ₹999 ₹0 for you

No cost to start enjoying premium benefits.

Plus, enjoy FREE MMTBLACK GOLD membership on joining.

Annual Fee: ₹999

Year 2 & Beyond: Spend ₹2.99L in a year to get your annual fee waived. Even if you don't, you'll still receive a ₹1,000 MakeMyTrip hotel voucher when you pay the fee.

Either way, you are never paying for these benefits!

Additional Discounts on Top Brands with RuPay & Mastercard

Customer Stories

Frequently Asked Questions

What myCash rewards can I earn with the card and how is the myCash credited to my MakeMyTrip Account?

- ₹6 myCash on every ₹100 spent on hotel bookings

- ₹3 myCash on every ₹100 spent on holiday package, flight, cab & bus bookings

- FLAT ₹25 myCash on train bookings

- ₹1 myCash on every ₹100 spent on other online & offline transactions

Transactions made using other payment methods like UPI will get you standard 1% myCash rewards.

Example: If you book a hotel on MakeMyTrip for Rs 10,000 and there is a 10% discount available, you save ₹1,000 on your booking. Since you used your MakeMyTrip ICICI Bank Credit Card, you earn myCash worth ₹540 (6% of ₹9,000) over and above the MakeMyTrip discount. This means your total savings & rewards amount to ₹1,540, which is 15.4% of the booking amount.

Your earned myCash will be credited to your MakeMyTrip account through your monthly statements. These earnings will be credited within 2 working days from the completion of your last billing cycle.

When will my MMTBLACK membership be activated? With the membership, will my myCash earnings from the card change?

When will the joining and renewal benefits be credited?

Step 1: On the payments page, select 'Gift Card' to view your linked MakeMyTrip hotel voucher

Step 2: Tap on the voucher and enter the amount to redeem (full/partial redemption available)

Step 3: Select 'Continue' to redeem the voucher. Pay the remaining balance using another mode of payment

I have not received my MakeMyTrip ICICI Bank Credit Card physical copies as of now, what should I do?

You will receive the physical cards within 7 business days from the date of approval of your request. An SMS will be sent once the card gets dispatched. In case you do not receive the card within 7 working days, please call ICICI Bank's Customer Care on 1800 1080 between 7:00 a.m. and 9:00 p.m. from your registered mobile number.

How can I convert large transactions into EMIs? Are No Cost EMI options available with this card?

You can convert transactions into EMIs in the following ways:

Step 1: Log in to ICICI Bank iMobile app or Internet Banking

Step 2: Tap on 'Cards & Forex' and select MakeMyTrip ICICI Bank Credit Card

Step 3: Select 'Manage Card'

Step 4: Tap on 'Convert to EMI' under 'More Options'

Step 5: Select your Credit Card Number from the dropdown menu & tap on the transaction

Step 6: Choose a convenient tenure for the EMIs and tap on 'Submit'

Additionally, a 3-month No Cost EMI option is available for booking hotels, flights & holiday packages on MakeMyTrip.

Can I link my MakeMyTrip ICICI Bank Credit Card with UPI? What rewards can I earn on UPI transactions made with the card?

If someone borrows my MakeMyTrip ICICI Bank Credit Card and uses it for their own purchases, will I earn for the purchases in form of myCash on my account?

How can I pay outstanding bill for the MakeMyTrip ICICI Bank Credit Card?

Alternatively, you can pay your credit card dues using 'Bill Pay' service on other platforms like Cred, Amazon & more.

Which credit card is the best for international travel?

Which credit card is the best for travel?

What is the best travel credit card?

How do travel credit cards work?

Is a travel credit card worth it?

Best Travel Credit Cards in India: Top Picks for Rewards and Benefits

Why a Travel Credit Card is Essential for International Trips?

- Complimentary airport lounge access (domestic and international)

- Accelerated reward points on flight, hotel, and travel bookings

- Discounts on bookings through partner platforms

- Travel insurance coverage and concierge services

Top Benefits of Travel Credit Cards for Frequent Flyers

- Airport Lounge Access: Unlike others, this card features no minimum spend criteria for lounge access.

- Joining Perks & Bonuses: Complimentary MMTBLACK GOLD membership that comes with joining perks up to ₹ 7,000.

- Zero Forex Markup: The best credit card for international travel, like the MakeMyTrip ICICI Bank Card, offers 0% forex charges, effectively.

- Guaranteed Rewards: 1% guaranteed rewards on UPI spends, with 1% myCash and additional up to 1% RuPay coins.

- No Rewards Expiry: Unlike other traditional credit cards, the rewards on this card come with no usage expiry and no restrictions.

MMTBLACK Membership: A Premium Travel Upgrade

How to Maximise Travel Rewards with Your Credit Card?

- Use it strategically: Book all travel—flights, hotels, cabs through partnered portals to earn bonus points.

- Pay for daily expenses: Many cards reward fuel, dining, and shopping, helping you earn faster.

- Redeem points wisely: Use them for travel vouchers, seat upgrades, or discounts on bookings.

Best Credit Cards for Travel: Earn Points and Enjoy Perks

- Effectively 0% Forex charges

- Lounge access with no minimum spend criteria

- 6% myCash on hotel reservations

- 1% myCash on outside MMT spending, both domestically and internationally

Is a Travel Credit Card the Best Option for Shopping and Travel?

- Extra points on online shopping

- Dining discounts

- Cashback on fuel

How Travel Credit Cards Work: Unlocking Rewards and Travel Protection

Credit Cards with the Best Travel Benefits: Top Features to Look For

- Annual Fees vs Benefits: Do the rewards outweigh the charges?

- Redemption Flexibility: Can you easily use your points for flights or stays?

- Lounge Access & Upgrades: How many entries are free, and where?

- Partnerships: Does the card have tie-ups with airlines, OTAs, or hotel chains?

- Extras: Things like credit card insurance for travel, concierge support, and emergency assistance.

Travel Credit Card vs Regular Credit Card: What's the Difference?

Best Credit Cards for Domestic and International Travel: A Complete Comparison

- Effectively 0% Forex charges

- No minimum spend criteria on lounge access

- UPI Benefits (1% myCash and up to 1% RuPay coins)

- No usage expiry or restrictions on rewards